tax return unemployment covid

Perversely because the unemployment benefits passed as part of the 2020 COVID-19 relief package were so generous those bills were expected to come in between 1000 and. Thousands of workers who received the Pandemic Unemployment Payment PUP and the Temporary Wage Subsidy Scheme TWSS payments have not yet filed a tax return.

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

COVID-19 Unemployment Benefits.

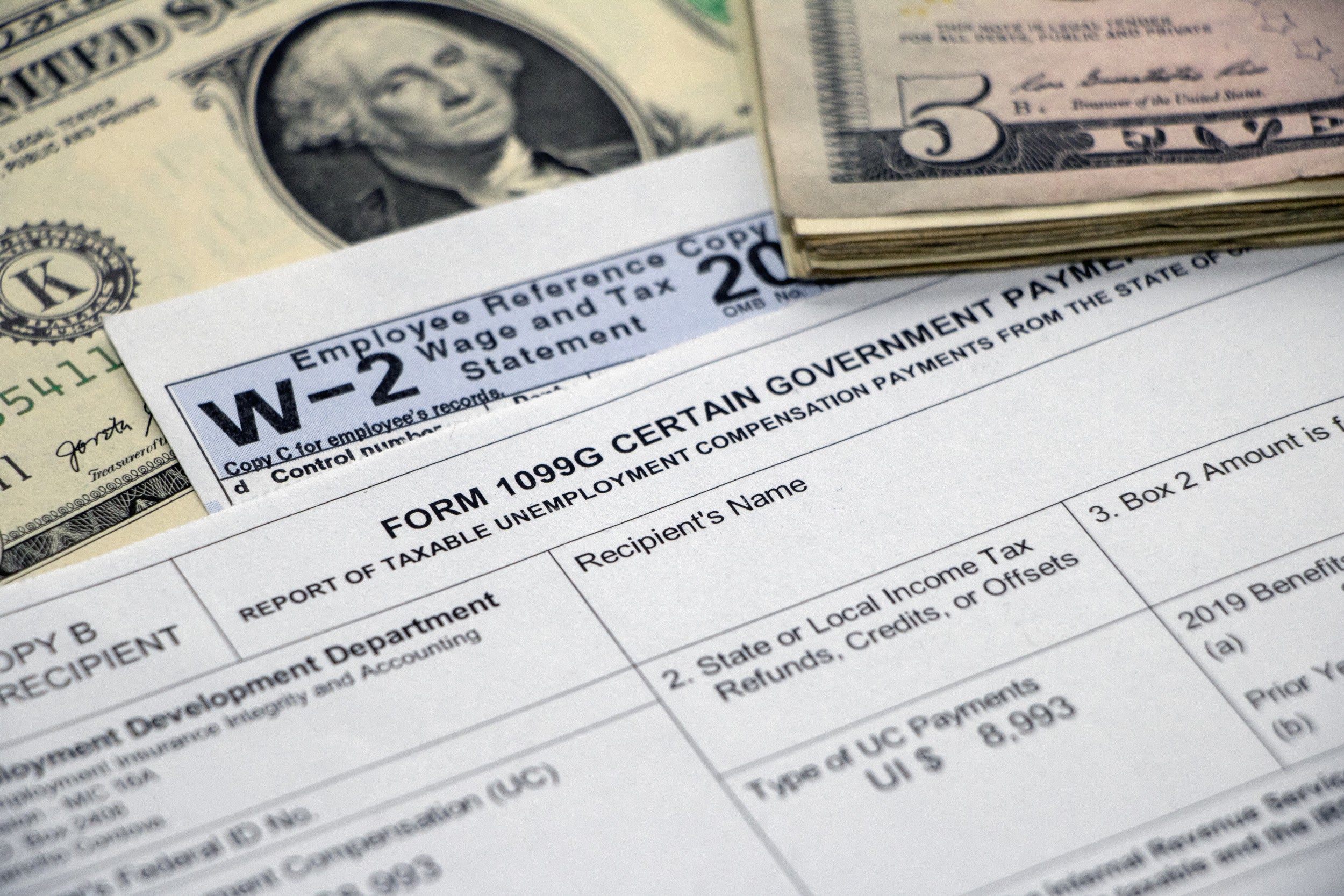

. But you may still qualify for unemployment benefits. IRS delays tax filing deadline to May 17 because of COVID-related changes Any Americans who received unemployment insurance will receive a 1099-G form that details. If you already filed your 2020 return but had unemployment income and would have benefitted from the new Covid bill theres a chance the IRS will take care of updating your.

The amount of unemployment income you received is reported in Box 1 and any federal tax withheld is reported in Box 4. However 181000 actually overpaid a total of 998m in tax. The Coronavirus Aid Relief and Economic Security Act CARES was enacted to alleviate the economic fallout of COVID-19.

For federal income tax purposes unemployment compensation is taxable. Unemployment benefits have always been subject to federal taxes and potentially state and local taxes depending on where you live but the additional 600 per week could. The Department is processing individual and school district income tax returns resulting in refunds.

For example both Alabama and Georgia have stated that if an employee is working temporarily in a different location due to COVID-19 the wages should be sourced based on. If you received unemployment also known as unemployment insurance the American Rescue Plan Act of 2021 reduced your federal adjusted gross income AGI for 2020 tax return. To be clear this includes your state benefits and the 600 payment from the feds.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. The due date for 2020 individual income tax returns and payments. The state depleted its unemployment insurance trust fund and borrowed 102 billion to maintain.

The PUP payment is now closed. If you applied for unemployment benefits the CARES Act allows. Taxation of Unemployment Compensation Received in 2020 and 2021 Generally unemployment.

Under normal circumstances receiving unemployment would result in a reduction of both credits when you file your tax return. COVID-19 extended unemployment benefits from the federal government have ended. The economy was at a standstill and tax revenues were expected to plummet.

They added that while 337000 taxpayers filed a return in 2020 some 126000 underpaid a total of 78m in tax. State tax withheld is reported in Box 11. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax.

PUP was available to employees and the self-employed who lost their job on or after 13 March 2020 due to the COVID-19 pandemic. The Department strongly urges taxpayers to file returns electronically. For example if you are single with an adjusted gross income AGI of 70000 and you received 15000 of unemployment benefits during the 2020 tax year you would enter.

Keep that form for your. In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable. Last tax season taxpayers were eligible for a tax waiver on unemployment income up to 10200 as part of the American Rescue Plan Act a comprehensive legislative package aimed at.

Lawmakers fixed this problem in the year-end. People who become unemployed for the first time are often shocked to learn that they must report their unemployment benefits more than 10200 on their 2020 tax return. The American Rescue Plan extended employment assistance starting in March 2021 and waived some federal taxes on unemployment benefits to assist those who lost work due to the COVID.

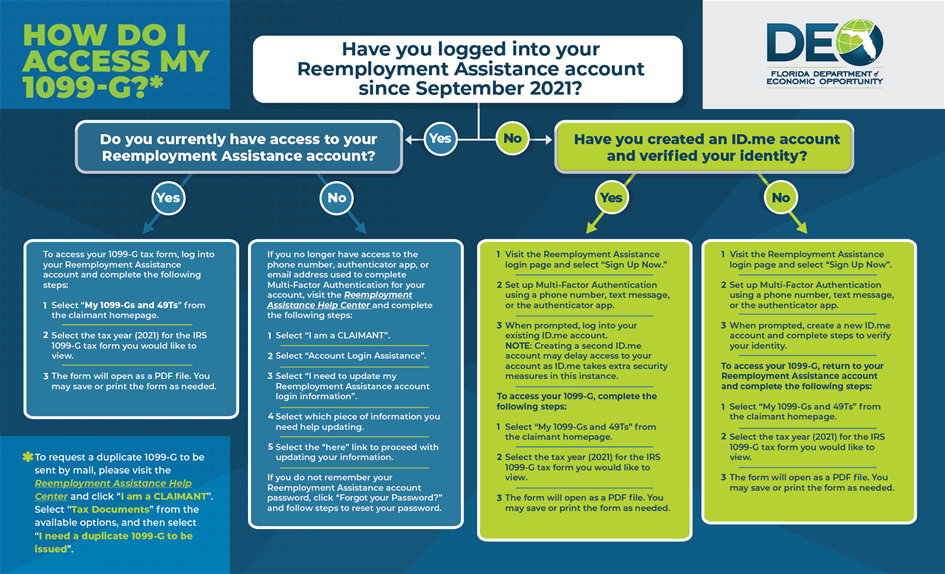

Tax Information Floridajobs Org

Five Ways The Covid 19 Pandemic Could Affect Your Taxes This Year

Millions To Receive Unemployment Tax Refund Youtube

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Rescue Plan Exempts 10 200 In Unemployment Benefits From Taxation

Covid 19 Coronavirus Tax Relief News Archives Optima Tax Relief

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Covid 19 Unemployment Benefits Hamilton Ryker

Felder Demands Tax Relief Again Ny State Senate

:focal(749x0:751x2)/unemployment-1-22fff4b7b8d04eb99138950bd7ae3bfe.jpg)

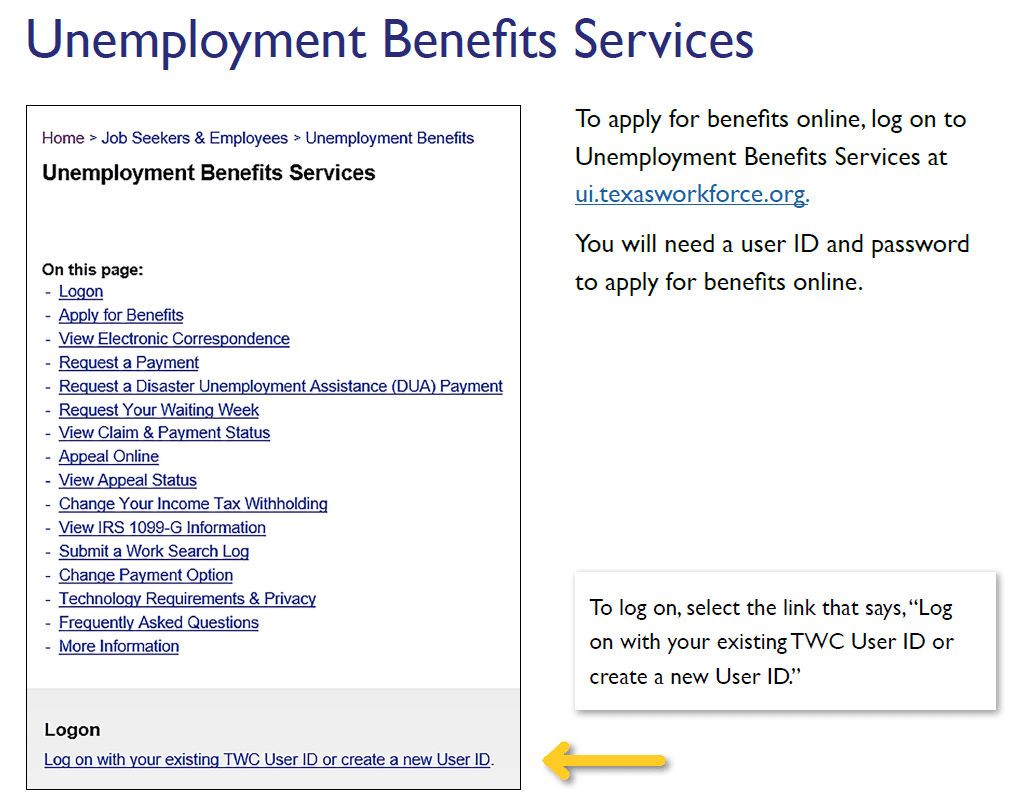

Coronavirus How To File For Unemployment Benefits

2020 Income Tax Filing Tips For People Who Got Unemployment Benefits Or Never Got Stimulus Check Abc7 Chicago

Some Taxpayers Can Expect Refunds After Covid 19 Relief Bill Gave Unemployment Tax Break 2news Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Stimulus Check Update When Will Plus Up Covid Payments Arrive

3 Most Common Questions Taxes Stimulus And Unemployment Wfmynews2 Com

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News